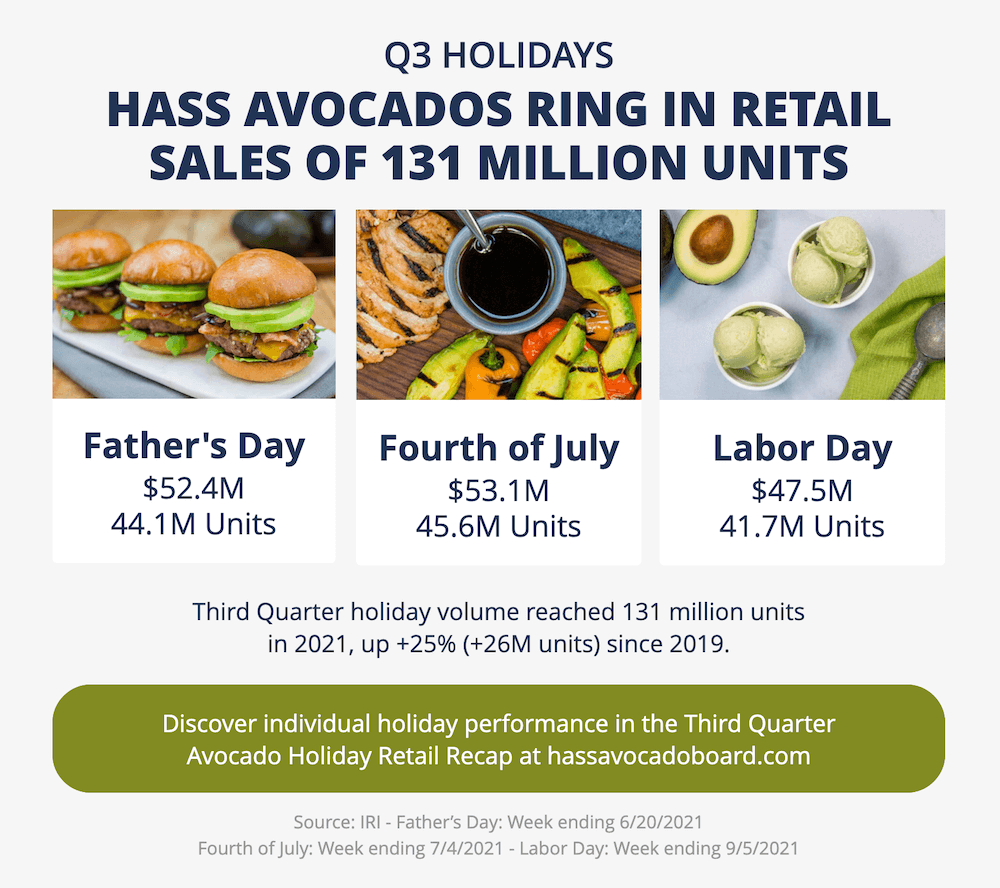

MISSION VIEJO, CA – (December 15, 2021) – The Hass Avocado Board’s (HAB) recently published holiday retail recap reported sales volume and dollars for Father’s Day, Fourth of July and Labor Day totaling a combined 131.4 million units and $153 million in retail sales as the fruit remains an important part of each holiday’s celebrations. Sales of fresh Hass avocados continue to remain above pre-pandemic levels of 2019, while year-over-year sales and volume have softened in comparison to the produce sales boom during the start of the pandemic.

As the only independent avocado organization that equips the entire industry for success, HAB produces quarterly reports about national holiday retail sales performance. The avocado holiday retail recaps provide insightful retail sales information for category managers, marketers, retailers, and industry leaders as they plan promotions and marketing efforts for the upcoming calendar year by tracking the most prominent holiday sales region by region and year over year. Many use the report to determine valuable growth drivers to impact their marketing strategy. The information below offers a brief snapshot of the sales and volume data for each holiday.

Key highlights from the report include:

Father’s Day

- Avocado sales volume during Father’s Day reached 44.1M units, which was up +27% vs. 2 years ago

- Nationally, Father’s Day sales declined -5% vs. prior year but showed strong growth of +5% compared to 2019

- On average, avocado retailers saw Father’s Day week sales of $1,387 and a volume of 1,169 units per store

- During Father’s Day week, avocado volume decreased -6% vs. prior year but showed +27% growth over 2019

- The average retail selling price of avocados increased by +1%, with price changes ranging from -10% in the Northeast region to +9% in the Plains

Fourth of July

- Per-store dollar sales during Fourth of July were strongest in the West and California, while South Central, Southeast, the West and California sold above the national average of units per store

- Avocado volume for Fourth of July week fell -9% below last year’s sales but soared +29% compared to two years prior in 2019

- Overall, dollar sales decreased -8% nationally, ranging from -6% in the West and -10% in the Northeast

- The average price for the Fourth of July ranged from $0.89/Unit in South Central to $1.42/unit in California

Labor Day

- Labor Day avocado volume skyrocketed by +6.4M units compared to 2019

- On average, avocado retailers saw 1,108 units and $1,261 per store during the Labor Day holiday week

- Unit sales increased +18% vs. two years prior

- Four regions recorded dollar growth for the holiday, including the Great Lakes, Midsouth, South Central and Southeast

- Nationwide, the average price for Labor Day week increased by +8% to $1.14/unit. The average price ranged from $0.91/ Unit in South Central to $1.25/unit in the Northeast

HAB releases a holiday recap each quarter, covering avocado sales trends for key avocado holidays and events. Each report details sales trends for dollar sales, units, and average selling price, which provides insightful information for planning future holiday promotions. For more information about avocado sales for each holiday, visit hassavocadoboard.com.

###

About The Hass Avocado Board

The Hass Avocado Board (HAB) exists to help make avocados America’s most popular fruit. HAB is the only avocado organization that equips the entire global industry for success by collecting, focusing and distributing investments to maintain and expand demand for avocados in the United States. HAB provides the industry with consolidated supply and market data, conducts nutrition research, educates health professionals, and brings people together from all corners of the industry to collectively work towards growth that benefits everyone. The organization also collects and reallocates funds to California and importer associations to benefit specific countries of origin in promoting their avocado brands to customers and consumers across the United States.