MISSION VIEJO, CA – (October 10, 2022) – Rising Hass avocado average selling prices (ASP) drove higher retail sales during second quarter holidays. A recent holiday retail recap published by the Hass Avocado Board (HAB) indicated increased dollar sales during Easter, Cinco De Mayo and Memorial Day. The spring holidays drove a combined 123.1 million units and $179.1 million in retail dollar sales. As the only independent avocado organization that equips the entire industry for success, HAB produces quarterly reports about national holiday retail sales performance. The holiday reports provide insightful sales information for retailers, category managers, marketers, and industry leaders as they plan holiday promotions and look for opportunities to grow avocado sales in the upcoming year.

The information below provides a snapshot of the volume and sales data for each Q2 2022 holiday.

Easter

- Easter week ASP increased +25.2% to $1.51/unit versus 2021. Higher ASP drove dollar sales to a 4-year high of $58.7M. Avocado volume for Easter week fell -10.4% from 2021 to 38.9M units.

- On average, retailers saw Easter week sales of $1,555 and 1,030 units per store. The West and California regions sold the most volume and had the highest dollar sales.

- With increased ASP across all regions, prices across the country ranged from $1.24/unit in South Central to $1.68/unit in the Northeast region.

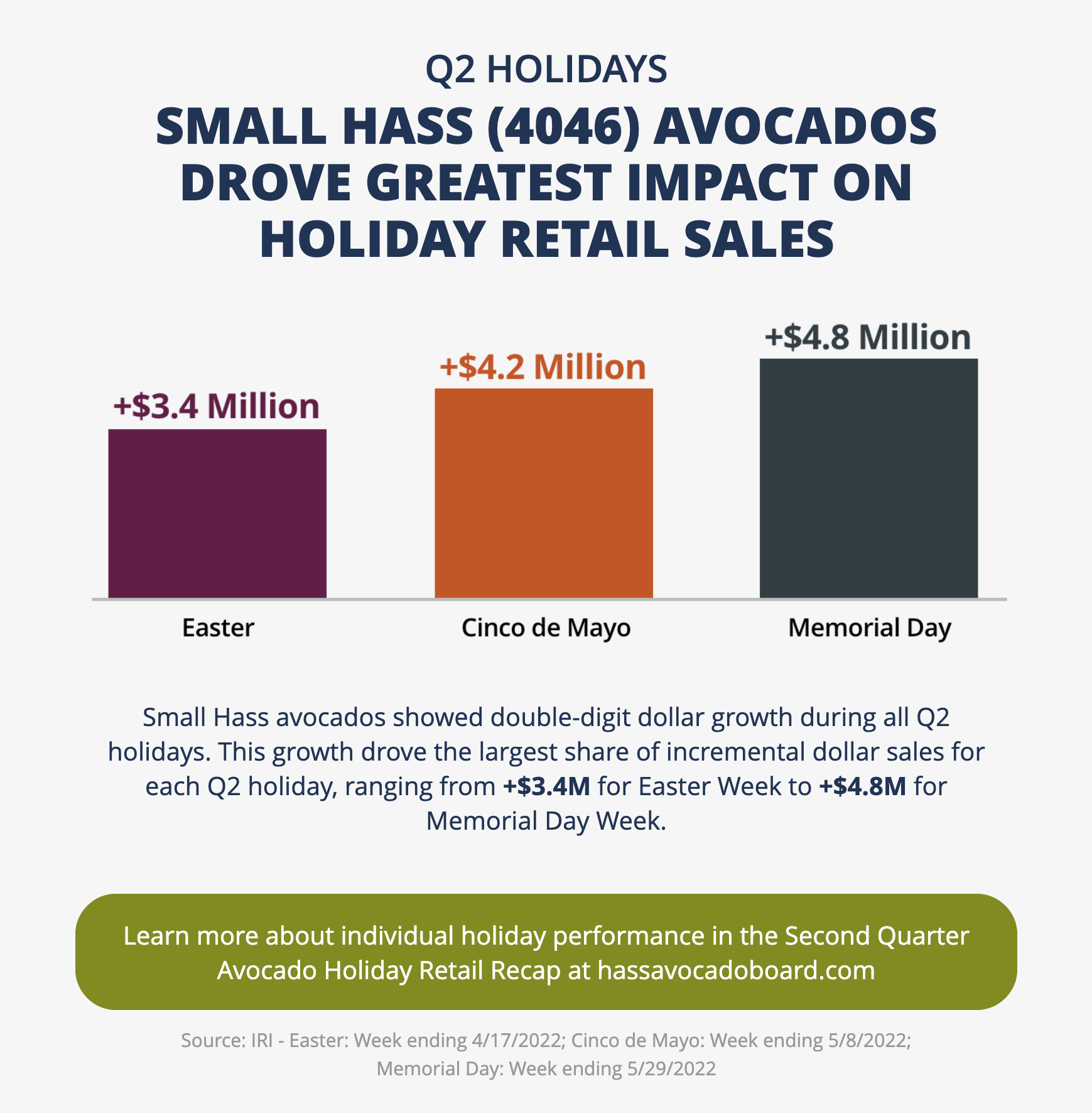

- Small Hass avocado dollar sales increased by +34.9% during the holiday, adding +3.4M to the category.

Cinco De Mayo

- Avocado dollar sales during Cinco De Mayo week reached $62.2M, up +14.5% over the previous year. However, avocado unit sales fell -9.8% to 41.8M units compared to the same holiday week in 2021.

- ASP during the holiday week was up +27% to $1.49/unit vs. 2021. Price increases ranged from +16% in California and +38% in the Northeast.

- Nationally, Cinco De Mayo dollar sales increased by +7.9M vs. 2021, with dollar growth posted in every region.

- During the holiday week, national volume decreased by -4.5M units when compared to the prior year. All regions posted a volume decline versus 2021 except the Great Lakes region.

Memorial Day

- ASP during Memorial Day week increased +32% to $1.61/unit, driving avocado sales for the holiday up +10% to $58.2M vs. 2021. Avocado volume declined by 16% to 36.1M units for the holiday week.

- On average, retailers saw sales of 955 units and $1,539 per store during the week. The West, Southeast and California regions had the highest per store unit and dollar sales.

- Nationally, ASP rose by double digits in all regions, +19% in California and +52% in the South Central region.

- Small avocados (4046) accounted for the largest share of total category, 26.7% of dollars, and showed the largest incremental dollar increase, adding +4.8M to the category for the holiday.

HAB releases a holiday recap each quarter, covering avocado sales trends for key avocado holidays and events. In each holiday report, users can view year-over-year sales performance for each holiday week. Each report details sales trends for dollar sales, units, and average selling price, which provides insightful information for planning future holiday promotions. For more information about avocado sales for each holiday, visit hassavocadoboard.com.

About The Hass Avocado Board

The Hass Avocado Board (HAB) exists to help make avocados America’s most popular fruit. HAB is the only avocado organization that equips the entire global industry for success by collecting, focusing and distributing investments to maintain and expand demand for avocados in the United States. HAB provides the industry with consolidated supply and market data, conducts nutrition research, educates health professionals, and brings people together from all corners of the industry to collectively work towards growth that benefits everyone. The organization also collects and reallocates funds to California and importer associations to benefit specific countries of origin in promoting their avocado brands to customers and consumers across the United States.

###