Long-Term Avocado Purchase Trends Study Reveals Key Trends and Growth Opportunities To Drive Sales of Hass Avocados.

The avocado category has experienced substantial retail sales growth over the past four years and ranks as one of the largest fresh produce categories. The Long-Term Avocado Purchase Trends study identifies data-based insights and growth opportunities based on retail avocado shoppers’ long-term purchase trends. This way, avocado retailers and marketers can enhance their marketing strategies with actionable insights into key shopper segments.

The Hass Avocado Boards (HAB’s) main goal is to develop with and provide to industry stakeholders updated data, research, and information to facilitate more efficient and orderly supply, a thorough understanding of demand and its drivers, and fluency in the societal trends affecting the performance of the Hass avocado industry.

HAB obtains and analyzes information from a panel of buyers’ representative of the market population, revealing how their purchase choices and habits impact avocado category growth in the retail channel. Receipts and products are scanned in the system or through an app. The panel is administered by Nielsen and IRI, who are the leading polling and retail surveyors in the United States.

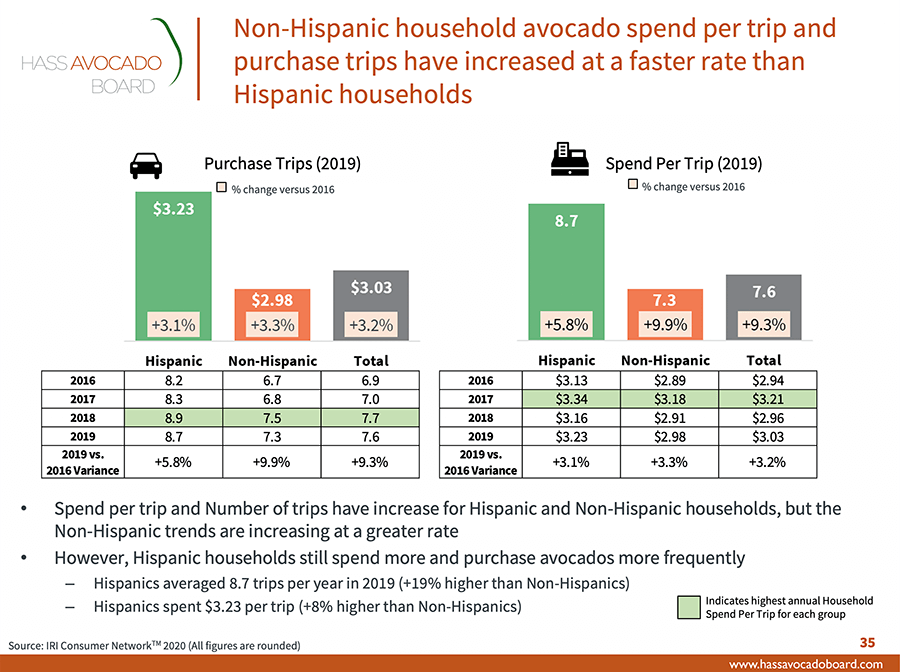

The Long-Term Avocado Purchase Trends study measures the impact that heavy volume avocado shoppers have had on the long-term category growth and how that compares to less involved shoppers. It also looks at the Hispanic versus non-Hispanic purchase trends and their roles in the future growth of the category. The study shows that the retail avocado category saw an increase of $250M in purchases from 2016 to 2019 and uncovers new growth opportunities.

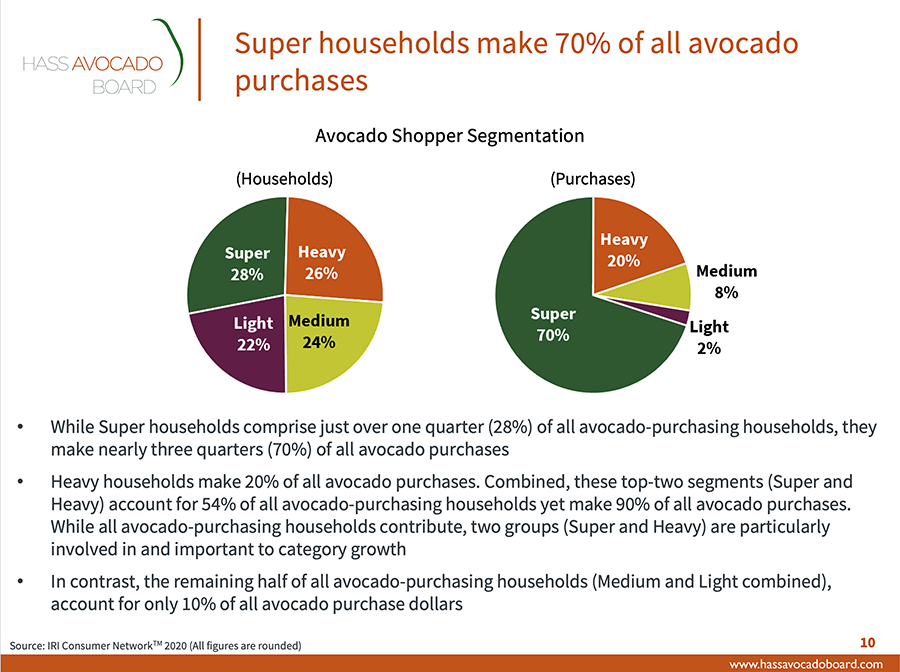

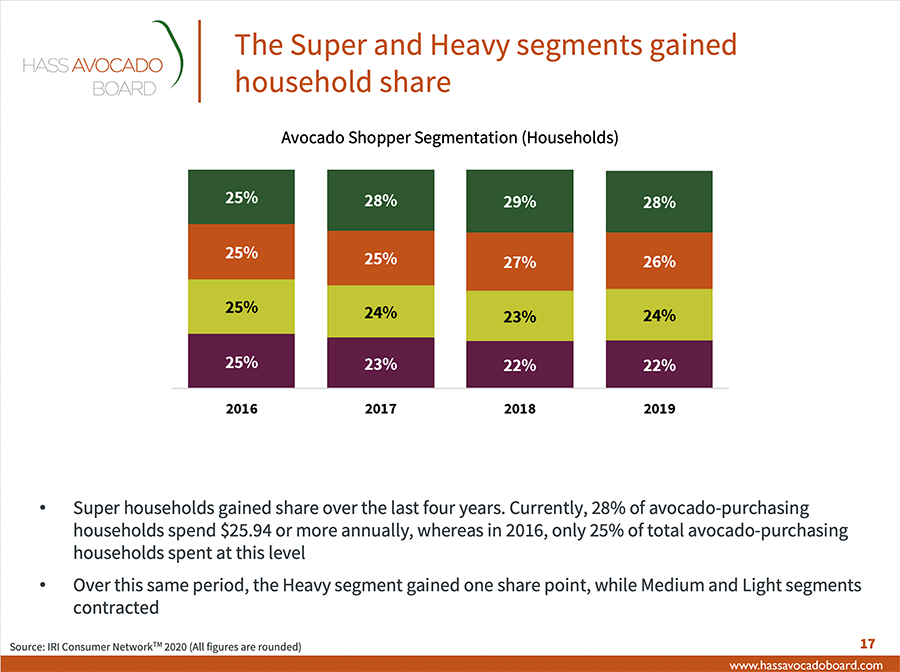

Some of the more relevant data becomes evident when you see that 50% of avocado shoppers (Heavy and Super shopper groups) make 90% of all avocado purchases. These same groups drove 100% of the long-term growth in the category during these years. Super shoppers made a powerful impact on the category, doing 70% of total category purchases and driving 94% of the growth. Understanding and engaging these shoppers is key to ushering in the next wave the category growth. Key actions and marketing efforts should be focused on these two groups to generate the most impact.

The study also shows that avocados increased the overall market basket value of avocado shoppers by 72% in 2019. Avocado shoppers increase the basket value not only by the cost of avocados, but any time avocados are in the basket, those shoppers tend to spend more in other products as well by more than $30 dollars in average. Knowing which products are compatible with avocados allows merchandisers to plan cross-promotions in order to drive shoppers into purchasing more avocados along with those additional products. We invite you to check our Research and Insights section to find more useful data about the market basket.

The Hass Avocado Board offers these insights and detailed retail information as the only avocado organization that equips the entire industry for success, with clear and actionable data and metrics that all can use to drive their avocado business.

Other Happenings

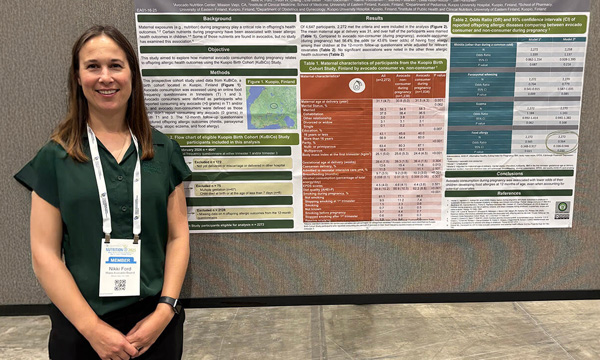

Connecting, Learning, and Leading: ANC at Nutrition 2025

The Avocado Nutrition Center brought cutting-edge science, new research findings, and fresh collaborations to Nutrition 2025: spotlighting avocados in maternal health, heart health, and beyond.

BOLD Class 4 Graduation Brings BOLD Graduate Count to 50!

Congratulations to the 14 members of BOLD Class 4 who completed their BOLD experience in Oxnard, California, on March 11th and 12th, 2025.

Experts, Insights, and Avocados: ANSA 2025 Recap

Top researchers met in San Juan Capistrano to help shape the future of avocado nutrition science.